Benchmark beef cattle prices to China free trade signing

By Patrick Francis

Monday 17 November should be a defining day in beef cattle business profitability if the signing of the China Australia Free Trade agreement lives up to the claims being made by politicians about it impact for the farmers involved.

Under the agreement tariffs currently levied on Australian beef, offals, hides and live cattle will be eliminated over four to 10 years. In total the potential boost to gross value of beef production is estimated at $270 million annually by 2024. With two other free trade agreements signed this year with Korea and Japan, 2014 should become the benchmark for Australian farm gate beef cattle prices

As a consequence of the agreements the Ministers for Trade and Primary Industries contend farm gate beef cattle prices should receive a sustained boost given greater competition for cattle in the market place – for both slaughter and live export animals. Beef cattle business profitability they contend will be positively impacted.

In the last decade there could not have been a better time for a new beef cattle demand factor to take effect. For most professional beef cattle producers 2013 – 14 represents an all-time low for their businesses as real prices (after adjustment for inflation) are below what they were in 2004, if not what they were in 1990. While the farmers involved know this, most politicians, farmer organisations, and advisor prefer to ignore the fact. Alternatively, they accept the low prices and continue to push farmers to increase productivity per hectare or per 100 mm of rainfall, despite the fact that the top 25% and followers have been doing that for at least the last two decades. There is a reluctance to accept that a ceiling is reached for cost cutting in economically and environmentally well balanced farm businesses, and the time must come for prices to increase.

The best demonstration of how price increases actually work for business performance is certified organic meat farming. Those producers achieve cattle prices 25 and 40% above the average for non-organic cattle (across the different types). Ironically for most certified organic cattle farmers costs per kilogram of live weight produced are often less than that of conventional farmers and their stock carrying capacity can be similar.

There are a range of other avenues for increasing prices at the farm gate by adding credence values to conventionally produced beef cattle, hence small premiums associated with MSA grading, a range of grass finished brands, a range of breed brands, and a small number of geographic based brands. Outside of this avenue there are a number of individually owned family and corporate brands being marketed domestically and for export which seem to be highly successful in terms of ensuring beef business profitability. The later demonstrate the value of beef production participating within the value chain rather than simply supplying livestock for the value chain.

The reality is that most beef cattle producers are suppliers to the value chain and their circumstances are not suited to being a participant in it. It should also be remembered that the majority of beef cattle farmers are not professionals and produce beef on a part-time or lifestyle basis and therefore are less reliant on price for business survival. It’s the professional beef businesses which dominate Queensland production that are under threat of failing if prices don’t increase significantly and take account of inflation into the future.

Analysis of the beef industry over 2013 – 14 demonstrate three amazingly different perspectives:

- Professional producers individually or in meetings reporting an unsustainable business future and business failures as they know prices are too low even with significant self-imposed cost cutting for decades to remain viable.

- Agri-businesses and governments are constantly upbeat for beef businesses to supply increasing demand from a growing middle income sector in Asia and particularly in China.

- A market reporting sector giving upbeat analysis of short-term changes with virtually no long-term actual and real price trends.

Three headlines and stories in the 6 November 2014 issue of Queensland Country Life demonstrate the three contrasting perspectives:

“Banks hush up as priest discloses foreclosure blitz” – a story about claims that 46 beef farms (“…the tip of the iceberg…”) in central west Queensland are being repossessed by banks.

“Beef in the box seat” – ANZ’s Queensland agribusinesses manager tells producers they are in the box seat to cater for China’s growing middle class.

“Exports bullish” – the paper’s market analyst reporting live export prices out of Darwin, Townville and Geraldton were bullish with prices for feeder steers and heifers ranging between 190 and about 240 cents/kg live weight.

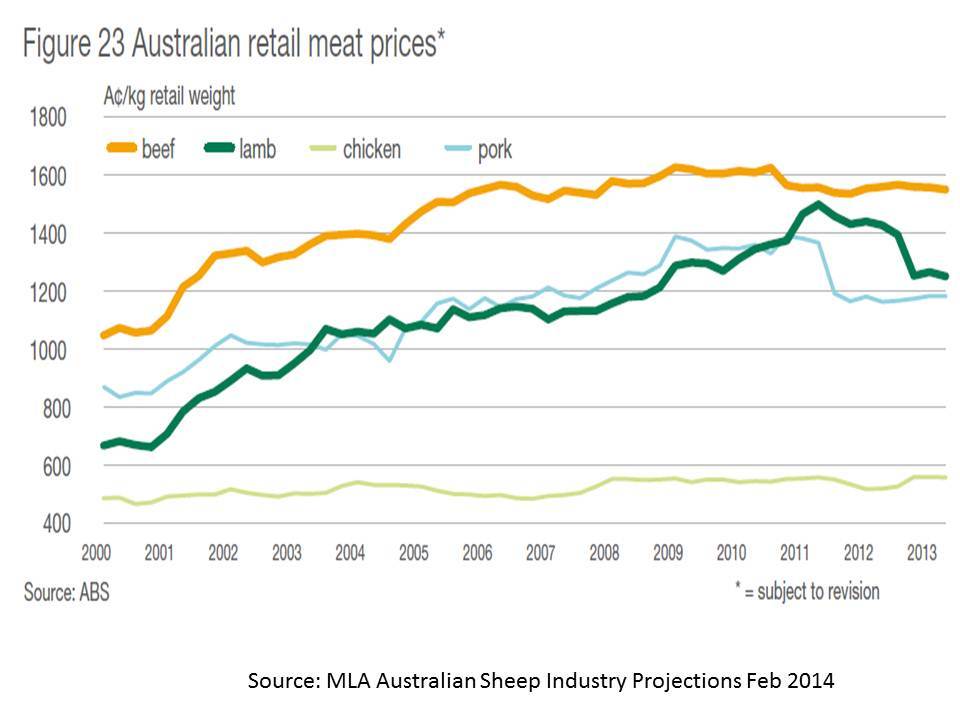

It is interesting that the Queensland Country Life does not include price trend graphs for different classes of cattle over time in its market analysis; the electronic publication Beef Central shows the Eastern Yearling Cattle Indicator price for only the current and previous year; and MLA favours actual prices over real prices in its trends analyses, figure 1.

Figure 1: Australian trade steer prices versus US feeder steer prices since 1998. Source MLA beef cattle mid-year update 2014

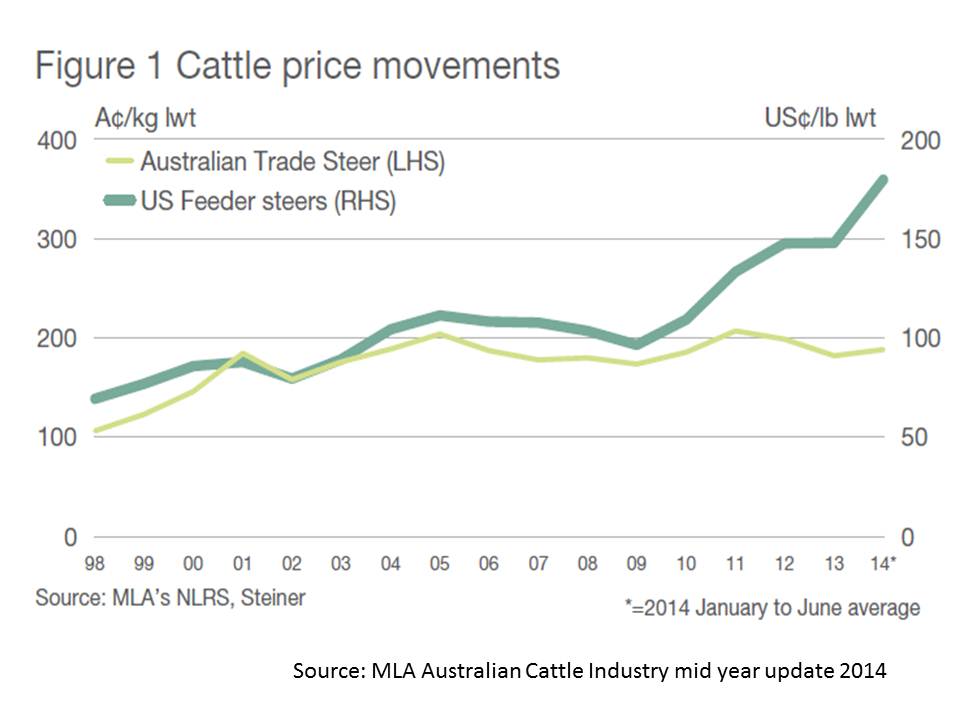

The federal governments commodities analyst ABARES has a ‘jeckel and hyde’ approach to market reports. It comments on the short term price changes and shows longer term trends in real prices in a graphic but makes no comment about the trends impact on business profitability.

In its latest Agricultural Commodities September Quarter 2014 it says:

The Australian weighted average saleyard price of beef cattle is forecast to increase by 12 per cent in 2014–15 to 328 cents a kilogram (dressed weight), after falling by 1 per cent in 2013–14 to 293 cents a kilogram. This largely reflects expected lower turn-off of cattle (particularly cows) for slaughter, assuming improved seasonal conditions in the latter half of 2014–15. If favourable seasonal conditions eventuate, producers will be encouraged to rebuild herds, increasing demand for restocker cattle. These factors, and continued high export demand for Australian beef and live cattle, are expected to lead to a higher average saleyard price in 2014–15.

Just below these comments is the graphic, figure 2, which is not commented on but clearly demonstrates the state of play facing beef cattle businesses. The reality being that even with “a higher average saleyard price in 2014-15”, in real terms the price is about 25% less than what was being received ten years earlier in 2004-05. Other longer term analyses of beef cattle prices demonstrate a slow decline in real terms since 1988.

Figure 2: Cattle and calf slaughter and weighted average saleyard price. Source: ABARES September 2014.

There is another curious perspective in the ABARES analysis of increased demand for Australian beef. In its analysis of the US market which mainly imports manufacturing beef (for hamburgers) it says:

Between the beginning of June 2014 and early September 2014, the export price of 90 per cent chemical lean manufacturing beef (90CL) increased by 42 per cent in Australian dollar terms.

It also provides a graph to demonstrate what’s happened to prices.

In contrast, in its review of the China market ABARES states:

Demand for imported beef and veal in China is expected to increase in 2014–15, as growth in domestic consumption continues to exceed growth in production. China is expected to increase imports from other countries, such as Uruguay, but Australia is forecast to remain the largest supplier to China (with market share just below 50 per cent).

But there is no reference to prices paid by Chinese importers or the types of beef and veal imported. Given that China has dramatically increased beef imports to around 160,000 in two years, figure 3, and is expected to become a more important market, surely price being paid should be analysed?

Figure 3: Australian beef exports to China since 1995. Source: MLA mid-year update 2014.

While the evidence is clear that China is an increasingly important new market for Australian beef, what is less clear is the price that will be paid for cattle to supply it. There has been little analysis to date about the impact of increased Chinese demand for Australian beef will have on price for cattle in Australia.

What is clear so far is that in the two years (2012-13 and 2013-14) since China has become a major importer of beef, real average saleyard price for cattle has continued to decline, figure 2, and actual prices remain unchanged figure 1.

What often goes unreported is the type of beef China is importing since 2012, much of it is low value cuts and offal. Their import into China may provide increased revenue at a wholesale beef level but it is not being reflected in prices paid to cattle producers.

In contrast, Rabobank’s China analyst Chenjun Pan reported in Industry Note 432, April 2014 that “Since 2000, beef prices (in China) have increased over fivefold, with an average year-on-year growth rate of 13%… Beef price movements have shown close correlation with GDP growth, which increased by the same pace over the same period. This reflects the fact that growing income levels and economic prosperity are enabling beef prices to reach their current levels. …During the same period, pork and poultry prices varied greatly, but saw a total increase of only 2 and 1.3 times respectively, due to ample supply and government support. Given the beef supply shortages that are likely to remain in the coming years, prices will continue to stay at high levels.”

Pan provided a graph, figure 4, showing how beef prices (for consumers) in China have increased since January 2000. He was asked to clarify why there is an apparent disparity between the escalating prices paid by Chinese consumers and the lack of impact of increased demand from Australia on the farm-gate price here when significant quantities began to be imported in 2012-13.

Figure 4: Retail prices for beef, sheep meat, pork and poultry in China 2000 – 20014. Source: Rabobank April 2014

He said while Australian companies have been exporting beef into high valued markets in China for many years, the reason for the surge in 2012-13 imports “…was indeed the low price of Australian (beef).

“If the Australia price increased, China imports from Australia would continue to grow but at a much slower pace and in the meantime shift to other countries for supply. This means part of the demand for Australia beef is consistent (high end markets) and the rest is volatile subject to prices,” Pan said.

Cattle Council of Australia president Howard Smith says the China Australia free trade agreement modeling suggests beef prices are estimated to increase by 8 cents/kg dressed weight above the current baseline level. Given cattle prices can vary for a host of reason by this much or more in a month then the agreement’s impact is unlikely to have a significant impact on profitability. Surprisingly Smith says there are also opportunities for increased farm gate returns through ensuring beef cattle farmers are paid for the co-products hides and offals. Given they are currently not paid for it is hard to understand why they will be in the future.

On the day the China Australia Free Trade Agreement was signed, the chairman of the FTA Taskforce David Larkin made a challenging comment on the retail price of beef in China. He said the removal of tariffs will mean “…alleviation of the inflated prices paid for Australian red meat and associated products by Chinese consumers”. It will be interesting to watch if the retail price of beef for Chinese consumers does decline or at least holds steady taking account of inflation, in contrast to its rapid rise over the last four years.

Take home message

This analysis provides a benchmark on which to monitor the impact of the China Australia Free Trade agreement for beef production businesses in Australia. Will the tariff cuts become a win-win for the entire value chain, or for that part of chain that starts after the farm-gate? The real price trend data for the last 10 years suggests that most Australian beef cattle farmers are not sharing in rewards of increased demand wherever it is being achieved around the world.

Box story

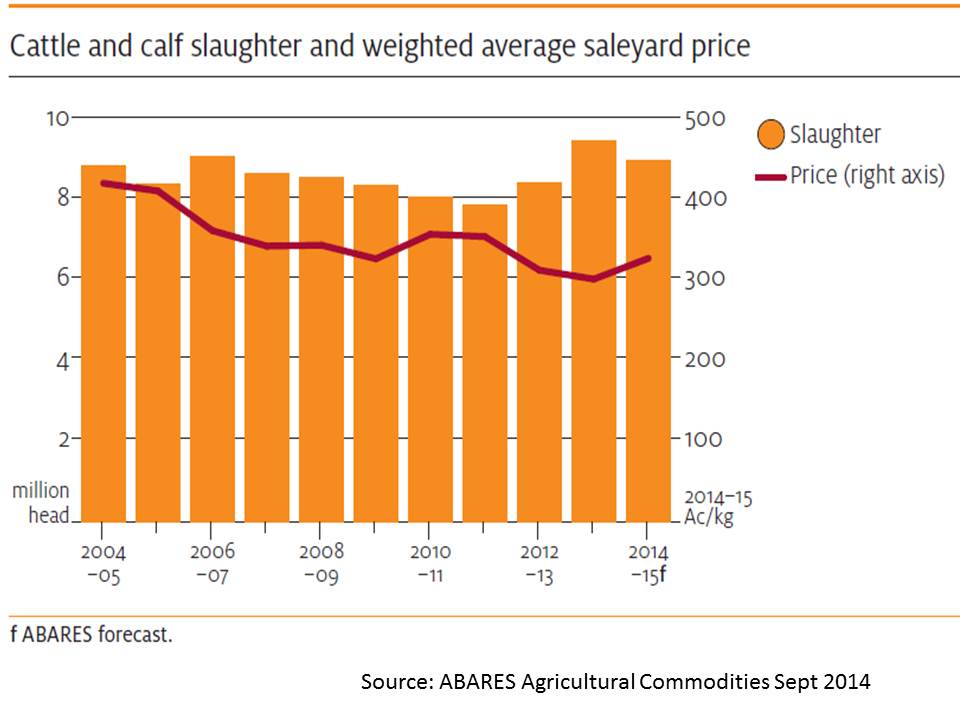

Domestic beef prices hits ceiling

One of the interesting components of analysing beef cattle prices at the farm gate is to understand the impact of consumer demand. The evidence from retail meat prices and consumption per head is that consumers have reached their upper limit for beef prices. Retail beef prices have plateaued since 2009, Figure 5. As well, beef consumption per person is declining, while the lower priced chicken consumption is increasing. Chicken consumption is now around 40 kg per person per year, while beef consumption has declined to around 30 kg per person per year.

Given around 40% of beef produced in Australia is consumed domestically, the impact of the stagnant retail price means players in the value chain must find savings to maintain margins in the face of increasing costs incurred. It is not surprising therefore that beef cattle prices have plateaued (figure 1) and in real terms declined (figure 2) as buyers put pressure on price paid to maintain their margins.

It should also be remembered that since 2010 the domestic market has experienced a rush of differentiated products associated with credence values considered important for consumers. For instance Coles has introduced no HGP beef and a host of pasture finished brands have been launched. While they provide a limited opportunity for farm gate price premiums at the industry level they have had little impact on prices.

It seems that consumers in Australia have become too used to low priced food so beef will struggle to reach a higher level based on a ‘fair’ price being paid at the farm gate. Capturing a greater share of the consumer dollars may only be possible once supply declines. This has happened in the US over the last three years with prices paid for feeding steers increasing by 75%, figure 1.

Figure 5: Australian retail meat prices 2000 to 2013. Source MLA