Crowdfunding African farmers

This is a novel and fast growing financing model, which essentially uses the Internet to connect borrowers and lenders. Crowdfunding can enable youth and women in agriculture to raise funds from multiple individuals through donations, presales/rewards, debt, or equity.

The approach has emerged as a new way of raising funds after the 2008 financial crisis, when traditional banks reduced their funding of artisanal businesses, start-ups, and entrepreneurial enterprises. Crowdfunding can be seen as a web-based extension of the informal finance mechanism used by youth (i.e., funding from family, friends, village saving clubs, etc.) that allows them to reach more potential contributors, locally and globally.

Since 2008, crowdfunding has expanded tremendously in the developed world, especially in the United States, Europe and Australia. In 2013, the global crowdfunding market was worth more than USD 5.1 billion, and is expected to reach a market size of USD 96 billion in 2025 (Raymond, 2014).

Even though crowdfunding finances mostly artistic and technological projects, agribusinesses are increasingly raising funds via this mechanism. For instance, in the USA, Barnraiser is a crowdfunding platform specifically designed to finance food and farming innovators with the vision to establish a healthy food world. Innovators are producers of healthy and artisanal foods, community kitchens and organic farms. Interestingly, crowdfunding is also being used by young Americans to establish themselves in farming by financing land acquisition, equipment and supply startup costs, which can reach USD 300,000 for individual ventures.

The crowdfunding platform ‘Kickstarter’ has 4.7 million contributors, and is used by many young American farmers to finance their establishment in agriculture. More than 600 farming projects, including dairy, chicken cooperatives, and organic produce, were thus financed in 2013. Following this outstanding growth in developed countries, the crowdfunding market is expanding in Sub Sahara Africa (SSA) due to the rise of the middle class, the rapid penetration of mobile technology, and strong demand from entrepreneurs .

Kiva success

Crowdfunding is increasingly being used to finance agriculture and potentially youth agripreneurs in Africa. ‘Kiva’ is a prominent crowdfunding platform that combines an online platform with field partners to deliver loans to poor, unbanked, and underserved in the developing world.

Kiva allows a minimum loan size of US$ 25 and is run by 450 volunteers around the globe. Since its creation in 2005, Kiva has allowed approximately 1.3 million lenders to provide more than US$ 700 million in loans via 295 field partners in 86 countries. A little more than 1.6 million borrowers received an average of US$ 416.50 through Kiva.

The average loan made by a Kiva lender is about US$10. The repayment rate of the loans is high, at 98.76%. In Africa, Kiva has 110 field partners through which loans are disbursed to the borrowers. These field partners are usually Micro Finance Institutions (MFIs) that review the loan requests, post them on Kiva platforms, and collect reimbursements. Also note Kiva Zip, an interest free model being tested in the USA and Kenya that relies on organizational testimonies about recipients in lieu of interest or collateral.

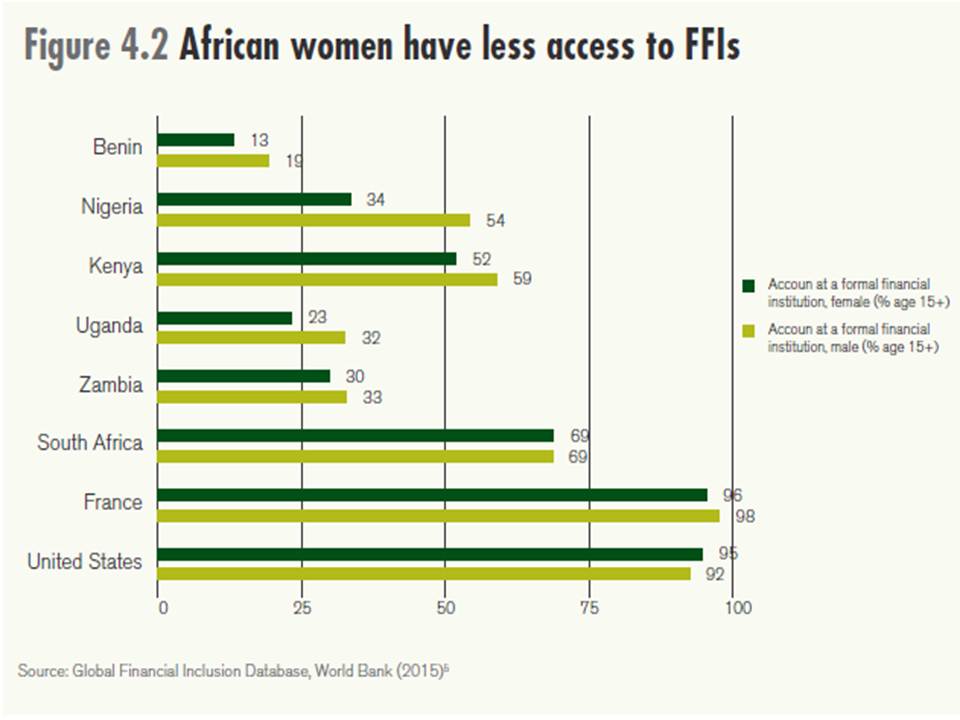

Figure 1: A low percentage African women have accounts with formal financial institutions. Source: Africa Agricultural Status Report September 2015.

Kiva is not the only crowdfunding platform in Africa with the potential to finance youth in agriculture. ‘Homestrings’, for instance, allowed entrepreneurs in more than 20 African countries to leverage funding especially from the diaspora and from impact investors. In 2013 this crowdfunding platform mobilized US$ 25 million with a minimum investment of US$ 1,000. It has a special focus on Kenya, Ghana and Nigeria. ‘Startme’ is another crowdfunding platform with reach in Africa and a focus on financing cause-related campaigns.

To sustain the development of crowdfunding platforms in SSA and the inclusion of youth agripreneurs to this funding mechanism, governments must establish a conducive environment via favorable regulations and the development and access to information and communications technologies. For example, companies should be free to raise equity as well as grants and loans through crowdfunding, without undue limitations (other than on the required level of transparency) from securities or banking regulations.

Cultural acceptance and trust between investors and investees are also important challenges affecting the rise of crowdfunding in Africa. Lastly, young agripreneurs seeking funds from crowdfunding platforms should be able to present innovative and compelling projects, which have to be backed by credible peers or the ‘crowd’, such as accredited local financial institutions, international NGOs and value chain actors. In doing so, the youth increase the trust of investors to participate in their project and reduce the risk of lending via this platform. Source: AGRA Africa Agricultural Status Report September 2015.