Why PCAS to identify Australia’s best known beef

Comment by Patrick Francis

Australia’s beef farmers grow and finish the majority of the nation’s slaughter cattle on pastures. Their beef is processed into chilled cuts for domestic and overseas customers and frozen cuts for export. About 30% of Australia domestic consumption and export beef is produced from cattle finished in accredited feedlots. The majority of domestic consumption feedlot finished beef is fed for 70 – 100 days so it can be labelled as “grain finished”. There are no statistics kept for the volume of domestic consumption beef that is grain finished compared with that which is pasture finished.

What is odd about this situation is that with the lifetime traceability provided by the National Livestock Identification System and quality assurance provided for every consignment of cattle sold for slaughter through Livestock Production Assurance’s (LPA) National Vendor Declaration, the question is not asked about how the animals were finished – on pasture, on grain in an accredited feedlot, or with grain supplements on pasture. Yet the National Vendor Declaration (NVD) does ask the seller if the cattle have ever in their lives been treated with a hormone growth promotant (HGP); if the cattle have been fed “by-product stockfeeds”; and if the cattle are “lifetime traceable”.

Each year I consign steers that have spent their lifetime on pasture to JBS Brooklyn abattoir. They are HGP free, meet chemical withholding period requirements, have lifetime traceability, LPA certification, and MSA grading eligibility all based on my personal declaration on a signed legal document. But there is no question in the NVD about whether or not the steers were ever fed grain. Despite traceability back to the farm no one in the demand chain past the farm gate asks this question, but we now know a growing percentage of consumers are interested in purchasing beef that spends a lifetime on pasture and is not fed grain.

Instead of insisting on a simple and legal declaration question on the LPA certificate about use of grain to finish cattle, Cattle Council now has a scheme where pasture finished beef farmers pay for accreditation to satisfy buyers about the bona fides of their animals’ pasture finished status. The system is called PCAS – Pasturefed Cattle Assurance System. It costs farmers to register and to have an annual audit undertaken to guarantee that they are doing what they are saying – that they don’t feed grains to their cattle. Recent media reports have announced that Woolworths are looking at stocking PCAS labelled beef in their stores.

The irony of PCAS is that registered beef cattle producers who never feed any grains to their cattle, are now paying for the privilege of telling consumers that fact. Further irony is the fact that consumers paying for PCAS labelled beef will pay a premium for the privilege despite the fact that most Australian domestic beef is produced off grass alone.

Simply put PCAS is not necessary for the value chain to identify pasture finished beef and promote it to consumers. All the supply chain needs to do is ask the question on the LPA and ensure traceability through to the boxes of cuts delivered to wholesalers and supermarkets. If pasture finishing or lifetime on pasture cannot be guaranteed then that is stated on the LPA and no claims are made by the retailer about it, which is the case for most of the beef sold in butcher shops and supermarkets today.

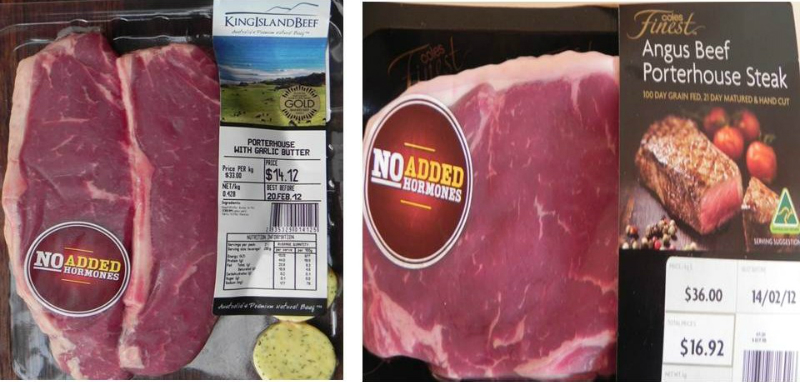

Traceable, pasture finished beef assurances out of LPA declarations already happen with commercial brands such as Angus Pure, King Island Beef, Cape Grim Beef, and Gippsland Natural. Their farmer suppliers don’t pay for an annual audit to verify the grain free status. Similarly the owners of cattle that become verified grain finished beef brands such as Certified Australian Angus Beef or Riverine Grain Finished or Coles Classic 100 day Grain finished are not audited on an annual basis to guarantee the status of the cattle before slaughter. The owners make a declaration to the buyers about the veracity of the grain feeding system.

Across these pasture and grain finished brands consumers purchase the product secure in the knowledge that the veracity of the statements on the packs are correct. There are other individual brand guarantees associated with both types of production systems which relate to the cattle farmers’ declaration on the LPA certificate such as use or not of hormone growth promotants and on the MSA certificate declaration such as time off feed etc.

The reality is PCAS is an unnecessary extra cost for pasture cattle farmers to bear to tell consumers what they have always been doing – finishing cattle on pasture without feeding grains. The fact that in drought years more cattle are finished on grain is not sufficient reason to justify PCAS. Even in such year when the value chain maintains demand for pasture finished cattle, there will always be some producers able to supply these animals even if they need to feed pasture silage or irrigate pastures to finish them.

What needs to be introduced into the domestic beef value chain to satisfy demand amongst consumers for pasture only product, is truth in labelling. Examination of all the Coles and Woolworths home brand beef packs and most butcher shop window case displays, reveals no statements about the meats origins or finishing systems. There are no statements about a lifetime on pasture or if grain finished. Yet Coles will guarantee no HGPs, and Woolworths will guarantee MSA grading on different lines – both are based on assurance provided by the beef cattle farmer. If such guarantees are legally sufficient for these characteristics surely they could also be for pasture only

finishing. It’s time to put this information on packs where it can be legally claimed through LPA.

There is one other irony in this story, farmers with their own feedlots or who custom feed in feedlots to finish their cattle want their grain feeding status recognised because it is accompanied by a premium price over grass finished product. It is difficult to see any farmers finishing cattle on grain declaring their cattle are grass finished to gain a PCAS price premium. Teys recently stated its PCAS premium will be 50 cents per kilogram carcase weight above the MSA graded price, but how that compares to a similar grain finished carcase prices is not revealed.

Another oddity in the pasture versus grain finished branded products is the fact that the country’s two major processors operate on completely different auditing mechanisms. Teys has adopted PCAS for guaranteeing its pasture finished branded product – Grassland Premium Beef. In doing so it takes advantage of Cattle Council administering PCAS farmer registration and on-farm auditing with the farmer paying an annual fee to cover its costs. In contrast, JBS Australia has introduced its own pasture finished Great Southern brand for south eastern Australia beef and lamb. Farmers register to supply and will be audited intermittently by a third party paid for by JBS, in other words there are no cost to the farmer for guaranteeing a pasture only system.

On-farm auditing for the purpose of declaring a pasture fed only product is an extra complication and expense to an existing quality assurance system which could easily accommodate this guarantee. Anyone who was involved in Cattlecare QA auditing knows how frustrating and aggravating such audits become after a couple of years especially when the business has always embraced practical on-farm QA for its own benefits. Beef cattle farmers need greater access to the value chain to lift business profitability so identifying beef from pasture reared and finished cattle is important. The solution for doing this is so simple with LPA that the industry should be lobbying retailers to ask the question on the NVD.

Lifetime traceability on the NVD could also be taken advantage of in beef’s value chain far more than is currently the case. Surveys suggest consumers are increasingly looking for farm origins when making decisions about fresh product purchases. Surely NLIS identification which allows for lifetime traceability could be monitored to identify in which states cattle are at least finished and processed and the information transferred onto beef cut packs. Consumers interested in supporting “local” could at least identify such a feature. Coles supermarkets has signs in some stores suggesting support for “local farmers”, apart from King Island branded beef, there is no indication on other beef offers where the cattle originated from. With grass finished cattle there should be an opportunity to identify at least 50% of the beef retail offer by state.

Take home message

Collecting data for the beef cattle industry from farmers through regulations like NLIS, and LPA involves a cost which is born by the farmers. There are costs involved for the supply chain, but they are inevitably passed back to the farmer. It is imperative therefore that data collected is in all possible cases manipulated to benefit farmers. When consumers say they are prepared to pay a premium for a guaranteed grass finished beef product, then the farmer and the retailer should be able to benefit. The mechanism for assuring grass finished status already exists through LPA National Vendor Declarations by adding the question about the feed the cattle were finished on. Another costly auditing program is not needed to declare what Australian beef cattle farmers do best – grow and finish cattle on pasture.