Chinese consumers versus the nation’s food and water resources

By John Boulter

According to the World Bank, China’s population in 2011 was 1.34 billion. This is expected to grow until about 2030, when it will peak between 1.45 and 1.5 billion. China’s annual fertility rate is 1.5 live births per woman and is well below the 2.1 level required to maintain an existing population. While total fertility rates are low, the expected increase in population to 2030 is due to an increased average life expectancy and the so-called “demographic bulge”: a high proportion of women at child bearing age.

China also faces the effects of a rapidly ageing population. According to a 2010 census, there were 180 million Chinese aged over 60. This is expected to double by 2030.

A corollary to the problem of an ageing population is a declining workforce. In 2010, for instance, there were 116 million people aged between 20 and 24. By 2030 this is expected to drop to 67 million. Expressed differently, the ratio of dependents to workers, which is below 40 per cent today, will increase to 50 per cent by 2032.

Further exacerbating the effects of an ageing population, is the rapid increase in life expectancy for those over fifty. Not only will there be one couple supporting four parents and one child, but the four parents will be dependent on that couple for a lot longer than their parents were.

China also faces rapid urbanisation. The number of rural dwellers is expected to decline from 900 million in 2010, to 400 million by 2040. China’s agricultural industry will have to become more efficient, with a smaller work force, if it is to at least provide the same amount of food.

Some experts have been urging the Chinese Government to relax the one child policy to reduce the problem of the ageing population. If such a policy were implemented, however, it would not have any beneficial effects on the demographic realignment until after 2025. In fact, it would mean a higher total dependency ratio and more mouths to feed in the short-term. The government has previously been reticent about entertaining notions of relaxing the one child policy, as it fears that it would incite a fresh infant bonanza, which is something the country may not be able to afford.

Some experts suggest a gradual relaxation, from a one to a two child policy, would be the best course of action in alleviating the looming demographic crisis. But there is no guarantee, however, that the population would increase significantly if the policy was relaxed, even though the number of people who would become eligible to have more than one child has grown substantially. Taiwan, for instance, which has no restrictions and is ahead in economic development, currently has a birth rate of less than one.

Changing consumption patterns

The rise of the middle class has brought about changes in food consumption. Gross Domestic Product per capita has increased from US$1,000 to just over US$5,000 in the past ten years. China’s middle class presently numbers around 300 million and is expected to increase to 600 million by 2020. Middle class in China is defined by the Chinese Academy of Social Sciences as having an annual disposable income of between 16,300 and 37,300 yuan (US$2,600 to US$6,000). Increased food consumption inevitably follows and thus daily per capita kilojoules consumption rose from 10,800 in the early nineties, to 12,400 in 2005-07. The United States, by comparison, had a daily per capita kilojoules consumption of 15,800 in 2005-07

Apart from a simple increase in the quantity of food consumed, consumption patterns themselves are also changing. Traditionally, the Chinese diet depended on vegetables for protein and grains for energy requirements, with a small amount of meat for flavour. The eating of meat used to be regarded as a luxury and a status symbol. Rising incomes in China, therefore, have brought about huge increases in demand for meat. In 2011, China consumed 71 million tonnes of meat, which is more than double the total US consumption. Nevertheless, on a per capita basis, Chinese meat consumption is still half that of the United States. This leaves room for growth, with the average three per cent year-on-year growth in meat consumption seen in the last five years showing no sign of slowing, even under recent price pressures; 73 per cent of this meat demand is pork, the consumption of which is deeply rooted in Chinese culture.

Producing meat requires significantly more land and resources than producing grains or vegetables. The grain-to-meat ratio for pigs is one kilogram of weight gain to every 3.5 kilograms of grain feed. This makes the increase in meat consumption a critical factor in examining China’s food and water security.

China’s principal grain crop is not rice or wheat, but corn, which is used to feed the huge population of swine in the country – numbering almost half a billion. One-third of China’s entire grain crop goes to livestock fodder. In addition to domestically growing grain to support its pig population, China imports large quantities of soybeans and corn. In 2011, China grew 14 million tons of soybeans, but consumed 70 million tons. As Chinese consumption of meat continues to grow, so will its imports of pork and livestock fodder; consequently, world prices of pork, corn and soybeans are also likely to rise.

Food Quality and Health

Reports of food safety scandals in China are numerous. One of the most publicised was the melamine infant formula scandal in 2008, which led to the deaths of six children with another 300,000 becoming ill. Analysts suggest, however, that many instances are not reported and that State censorship also plays its part in suppressing reports. Food producers and processors have major incentives to cut corners, especially when profit margins are thin, as they often are for rural households.

In the first half of 2012, Chinese authorities found 15,000 instances of unsafe food practices and shut down 5,700 food businesses. China recently issued a new five-year food safety plan, but inefficiency and corruption remain major problems. As Stanley Lubman, a specialist in Chinese law at the University of California Berkeley School of Law, puts it: ‘There is often a serious disconnect between laws and policies issued by the central government and the level of enforcement and implementation put into effect by the local governments.’ Responsibility for food safety is unclear, with much of the country’s food production effectively unregulated. The use of illegal chemicals and the overuse of legal chemicals, remain as serious problems in China.

Water resources unevenly distributed

In 2009, China had per capita water resources of 2,079 cubic metres per year, against a world average of 6,225m3. This is expected to shrink further, to approximately 1,760m3 cubic metres per year, according to United Nations estimates.

The water that China does have access to is unevenly distributed, with the south-east receiving plentiful rainfall; so much so that it experiences regular flooding. The Yellow, Liao, Hai and Huai Basins to the north, however, which support two-thirds of China’s cropland, receive insufficient and highly variable rainfall. Underground aquifers and surface water have been overused so that large swathes of high quality arable land are now severely deficient in water. Once underground aquifers run dry and surface water becomes scarce, irrigation in these basins will have to rely on rainfall, which will result in lower crop yields. In some regions of north-east China, groundwater is expected to run dry within thirty years. Water will be a major constraint to China’s growth as the country struggles to feed 1.5 billion people when its population hits its peak in 2030.

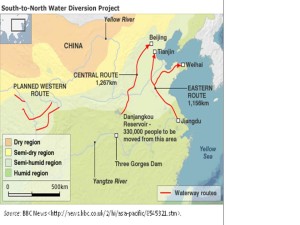

The limited availability of freshwater resources in China is compounded by endemic pollution; in some cases it is so bad that the water is not suitable for irrigation. A lack of freshwater in the north has led the central government to embark on an ambitious project to divert water from the south. The South-North Water Diversion Project, figure 1, once completed, will be the largest water diversion of its kind in history. The plan is to divert 44.8 billion cubic metres of water per year from the Yangtze River and its tributaries through three separate canals. The first stages of the Central and Eastern Routes are expected to be completed by 2014. The Western Route, however, is only in the planning stages of development and is not expected to be completed until 2050.

There are concerns over whether the Yangtze and its tributary the Han River have sufficient water to supply the northern region. The Yangtze River is heavily polluted, however, and this will generate a new set of environmental problems for the people who rely on the Han River. It will also divert water away from an already fragile Yangtze River. With the Yangtze so polluted, there are currently over 400 water treatment plants used in the entire diversion project. Despite this, the water quality after treatment was reported in 2010 as poor. The government-sponsored China Daily reported in 2012 that water quality along 90 per cent of the Eastern Route met minimum requirements for safe drinking.

Water use in agriculture is quite inefficient and there are opportunities to increase its effectiveness. According to a 2009 World Bank report, only 45 per cent of the water drawn for agriculture is actually used on crops. Only 40 per cent of water is recycled, compared with 75 per cent to 85 per cent in developed countries.

Part of the problem in the agricultural sector is the comparatively low cost of water, where the government is trying to ensure that rural incomes do not decrease. The authorities do not want to raise the price of water and, consequently, the allocation of the water is generally inefficient. In most irrigated farmland, farmers pay for the amount of land irrigated, rather than how much water they actually use, which provides no incentive for the efficient use of water.

Industrial water use has increased at an annual rate of six per cent per year since 1990 and shows no sign of slowing down. To continue its economic growth, China still requires more energy. Although there have been major investments in renewable energy, coal power is still the largest part of the energy mix. Coal requires considerable quantities of water to mine, process and consume and accounts for about one-fifth of all water consumption in China. The central government projects a 30 per cent increase in coal production by 2020, which does not bode well for water security in China.

Desalination might seem an attractive option to assist with China’s water security; however, this requires considerable energy, which in turn requires water. Unless energy production moves away from sources that require fresh water, desalination is not a solution.

Arable Land

There has been a slow but steady loss of arable land, with a loss of 1.03 million hectares (mha) per year lost from 1997 to 2008. According to the World Bank, there was 0.08 hectares of cultivable land per person in 2008, which is low compared to the world average of 0.2ha. As defined by Canadian geographer Vaclav Smil, a country with less than 0.07ha of cultivable land per person is insecure. This continued loss of land led the central government to set a “red line” target. The “red line” sets a minimum of 120 mha of arable land across the whole country and the government will attempt to prevent arable land from declining below this level. Whether this will be achieved is highly questionable. Projections by the Bank of America indicate that there will be 117mha of arable land by 2015. By 2030, when the population reaches its maximum, arable land of 105mha would put China in the category having a scarcity of arable land. The Chinese Government has put in place many restrictions governing the conversion of arable land, but how the “red line” holds up, depends on the ability of the central government to enforce planning and environmental law.

The staggering pace of urbanisation in China in recent years is a major factor in the loss of arable land. In 1978, 17.2 per cent of the population were urban dwellers, whereas in 2008 the country was 45.7 per cent urbanised. This is expected to increase to approximately 57 per cent by 2025. Urbanisation has been a component of the 12.3 mha arable land loss since 1997.

Ecological restoration

However, ecological restoration efforts especially in the “Grain for Green” programme, account for the largest proportion of land lost to farming since 1997. In fact, 58.7 per cent of the arable land lost to 2008 was due to ecological restoration, compared to 20 per cent through urban and industrial construction projects. Ecological restoration efforts largely focus on converting land that was only marginally viable for agriculture, such as eroded slope farmland. Conversion of arable land by planting trees or turning it into grassland is easily reversible. On the other hand, conversion of land for residential and industrial use is practically irreversible. Chinese law now requires that any arable land taken over for use in industrial projects must be offset by land reclaimed for agricultural use. Land reclaimed for agricultural use, however, is often of lower quality than that taken over by construction projects or restoration efforts.

Laws are often flouted by local officials, who are able to forcefully acquire land and corruptly sell it to property developers. The Chinese Academy of Social Sciences estimated that in 2010 about 65 per cent of the 187,000 protests reported in China were related to land rights. Data on the number of illegal land acquisitions is sketchy, as local government officials are expert in concealing illegal land acquisitions.

This poses a major problem for the central government in achieving its goal of retaining 120mha of arable land. The law means little when it is not adjudicated independently and there is no recourse for ordinary famers through the courts. Lawyers fighting for the land rights of farmers are routinely jailed and mistreated. There is little likelihood of a change in the status quo in the foreseeable future, with mostly conservative politicians obtaining seats in the powerful seven-person Politburo Standing Committee in 2012. The ruling class is unlikely to risk its vested interests for the sake of good governance and a strong legal system. Therefore, it is questionable whether the central government’s “red line” target will hold up, unless there is significant political reform.

Agricultural modernisation

Many improvements in agriculture are the result of market-based reform. To cope with the future reduced supply of labour, many efficiency gains must be made. Much of China’s agricultural land is farmed in a fragmented way. Plots are allocated to households and each household tends to its own plot or plots. A single farmer may have multiple plots in different locations in a village, which all need to be tended by hand. Uncertainty about land rights means that households are reluctant to invest in expensive machinery. It also means that there is less incentive to farm in a sustainable way. A more robust land rights system, aggregation and mechanisation are the requirements for further sustainable efficiency gains.

As of 2009, 49 per cent of China’s farmland had some form of mechanisation; an increase of seven per cent from 2007, but still well short of developed countries, where most agriculture is large scale and mechanised. China will need to find a way towards larger scale farming, and in this perhaps the rapid urbanisation and lack of people willing to be farmers will help.

Investment in R & D

Until recently, China has repeatedly produced impressive increases in crop yields. It has achieved this largely through technical progress such as increased fertilisation, irrigation and the hybridisation of higher yielding and more resistant crops. Grain yields per hectare have increased significantly since 1980 and more particularly in the last decade. USDA data shows between 2004 and 2011 wheat output increased by 28% (91million tons to 117mt), rice increased by 16% (113mt to 133mt), and corn increased 47% (130mt to 191mt). With limited land and water, the question now is whether growth can be sustained through continued agricultural research and development. Grain output in China is reported by the Chinese media to have risen 3.2 per cent year-on-year to 2012, but concerns have been expressed in the Western media about the accuracy of these figures.

Between 2001 and 2008, public research and development funding doubled. The private sector increased its share of R&D funding to 16 per cent of the total in 2006; although private investment is still hampered by rather loose intellectual property laws and poor enforcement. Despite large funding increases in recent years, China’s research intensity ratio – the ratio of total public spending on agricultural R&D to national agricultural output – at 0.5 in 2008, is quite low compared to developed countries, which typically have a ratio of about 2.5.

China has some issues to address in its research and development. The various research institutes are not centralised and, while this may allow them to focus on local projects more effectively, it is likely to produce inefficiencies, such as doubling up on research projects. In addition, there is a distinct lack of qualified research personnel.

Chinese foreign investment in agriculture

Data on Chinese investment on agricultural land is sketchy at best, even in developed countries such as Australia. Although the purchase of agricultural land in Africa has been widely reported, details are hard to come by. It is clear that Chinese companies, often state-owned, are to some extent buying up foreign agricultural land; but it is far from clear that this is a deliberate strategy aimed at ensuring food security. With food prices rising, many investment analysts would suggest that investing in farmland or agribusiness is part of a solid overall investment strategy. In fact, in 2010, only about one per cent of Chinese foreign direct investment was related to agriculture.

In 2008, the Financial Times reported on a draft policy from the central government that would make offshore land acquisition a priority, a claim that the Ministry of Agriculture strongly denies. In addition, the Ministry has expressed doubts that this would help China’s food security situation. There are a multitude of problems in trying to achieve food security in this way, sovereign risk and economic viability being among the major ones. It is more likely that Chinese investment in foreign agriculture is merely a part of the wider “go out” strategy of foreign investment. That said, in 2012, the National Development and Reform Commission identified agriculture as a priority as part of the “go out” strategy.

Implications for Australia

Objections seem to arise that Chinese companies are buying up farmland only to feed China itself. The fact is that Australia is already a net exporter of food and only approximately six per cent of all farmland is fully foreign-owned. Of that six per cent, only a small fraction is Chinese-owned, with the US and UK much bigger players. In Queensland, the only state with an extensive foreign acquisition registry, China does not feature among the top six countries by total land area owned, although in 2011-12 it spent more on land in Queensland than any other country.

The effect of rising food prices on global stability is the most immediate concern to Australia. Solving China’s food security will inevitably involve turning to global markets, as has occurred in developed Asian economies such as Japan and South Korea. Resource pressures will cause food prices to rise in China and around the world as China increasingly turns to world markets to feed its population.

China’s citizens should be much better equipped to cope with higher food prices than citizens of poorer countries. Rising food prices may cause some political instability in China, but the effects are likely to be greater in poorer countries.

Find out more:

John Boulter is a research analyst with Future Directions International (FDI) Pty Ltd Perth WA, phone 08 9389 9831, visit www.futuredirections.org.au to subscribe to its newsletter. A full version of this report is on the FDI web site.